Blog

Short Sale vs. Foreclosure

Buying your own home is a dream for many people. It requires a lot of discipline and good credit standing. But sometimes, there are unexpected life events that can turn a person’s dream into a nightmare. You may lose your job or income and end up taking on more debt.

There are two options you may consider if you get behind on your mortgage payments: a short sale or a foreclosure. In this article, we’ll discuss the difference between a short sale and foreclosure, as well as how to tell which option is better for you.

What is a Short Sale?

A short sale is a voluntary process that happens when the homeowner sells the property for an amount that is less than what is owed on the mortgage. For a short sale to happen, the lender must approve to accept a lesser amount than the total mortgage owed. If the lender accepts the short sale terms, the mortgage will be settled and the borrower will be released from any further liability once the short sale has closed.

What is Foreclosure?

Foreclosure is a legal process in which the lender repossesses and attempts to sell a property after a borrower is unable to meet their repayment obligation. Typically, foreclosure starts when the borrower missed three to six consecutive months of mortgage payments. The lender will issue a Notice of Default to let the borrower know that he is at risk of foreclosure and give him a reinstatement period to pay off debts and settle other disputes.

If the mortgage’s balance was not paid within three months, the lender will issue a Notice of Sale and sell the foreclosed property to an auction. If no one buys the property at auction, the lender becomes the owner and it will be considered a bank-owned or real estate-owned property.

What is the difference between a Short Sale and a Foreclosure?

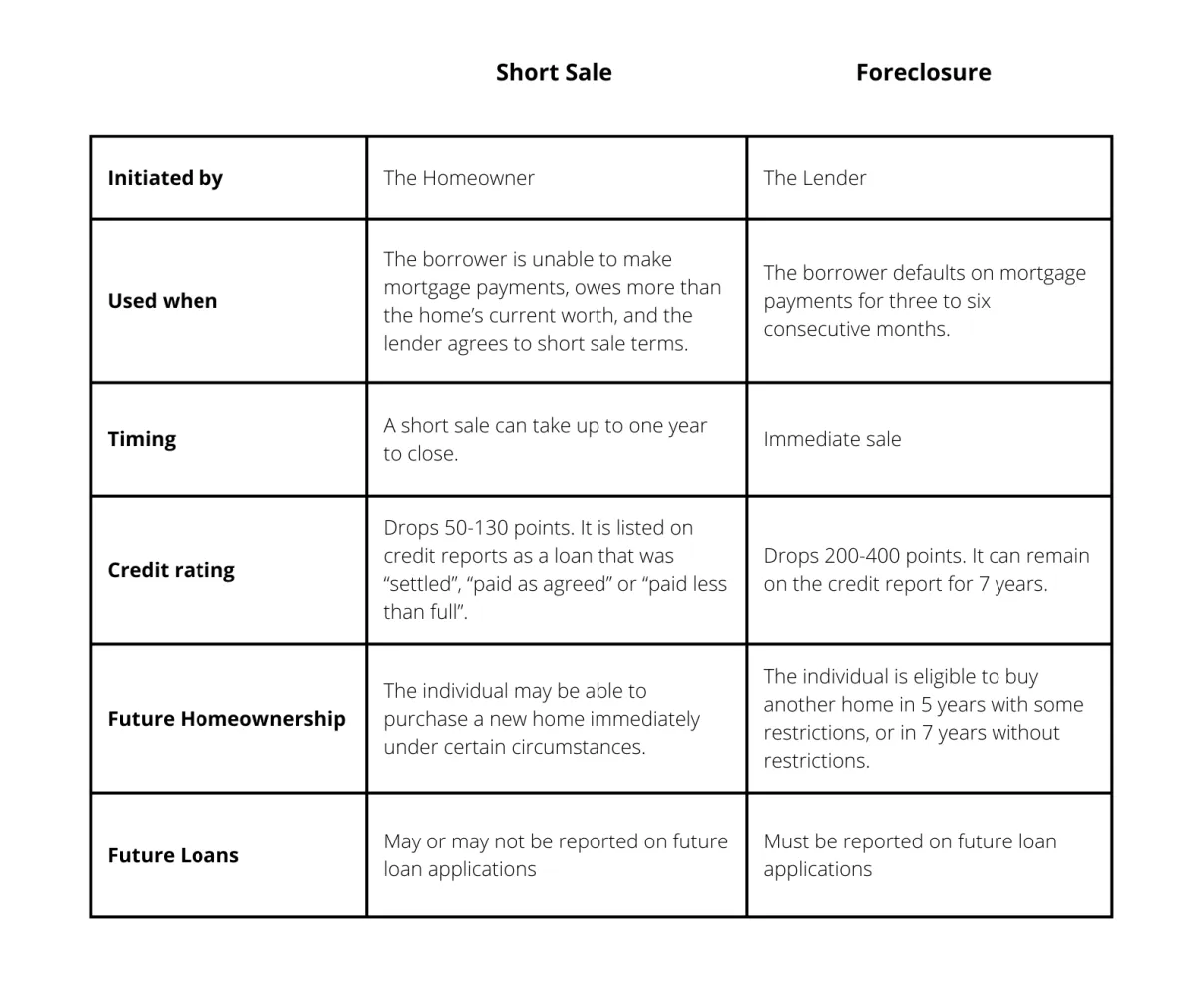

Short sale and foreclosure may be similar as they are both financial options for homeowners who find themselves in financial distress. Both also hurt credit scores and tax returns. But, short sales and foreclosure differ in process.

Conclusion

At first glance, short sales and foreclosure may seem similar. After all, they both occur when a homeowner is having trouble keeping up with his mortgage payments. However, you need to know that some important differences exist between them. Foreclosure is something that any homeowner or borrower would not want to experience. On the other hand, if short sales are done rightly, there are still some benefits to the borrower as it may not do as much damage to the owner’s credit score as a foreclosure would. Because of this, the borrower won’t have to wait for a longer time to buy a new house as compared to undergoing a foreclosure process.

We are a real estate consulting team that specializes in creative solutions for homeowners with troublesome houses or situations. We work fast and with integrity to ensure win-win solutions for everyone.